"The capitalistic system has failed us." A mantra of the liberal side of the political aisle. I don’t think the system has, I think we aren't using the right measuring tool.

"The capitalistic system has failed us." A mantra of the liberal side of the political aisle. I don’t think the system has, I think we aren't using the right measuring tool. The news reported that Fannie Mae and Freddie Mac are poised to need nearly twice as much money as originally estimated. This isn’t a systemic problem with capitalism; it is an issue with the institutions themselves.

Both institutions are an example of the government attempting to control a cyclical market by interfering. Nothing against blind people but this is kind of like having Helen Keller drive the car because she knows how to turn the steering wheel.

The adjustments that the bureaucrats make would always be misguided overcorrections that would eventually lead the entire operation to veer off the road. The natural market “wobble” would fearfully encourage a push in the other direction to attempt to compensate for a force of unknown magnitude.

The system did not cause the problem, those trying to guide the system caused the problem. Blame can be laid on both political parties’ heads, but the reality is that the market cannot be controlled because it is reactive to the very market it resides in.

Stocks go up and more stocks go up. Stocks go down and more stocks go down. You cannot isolate the market from the market any more than you can isolate the capitalist system from the system.

So, what is my solution to the issue? The government should divest itself of the two institutions. On the farm when the cow doesn’t produce milk anymore it produces beef.

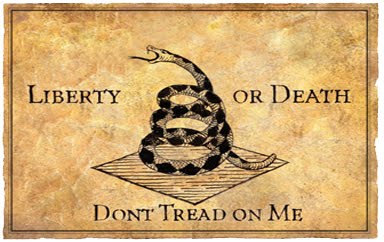

Sometimes the Natural Cycle Works Best.

.jpg)

No comments:

Post a Comment